Posted by Erik Mueller for Old Republic Surety Maybe you’re bidding on your first public project, or the financiers of a private job require a bond. You may have previously qualified for a Fast Bond program, which is available for small projects, but now you’ve graduated to standard contract bonds. You’re probably a bit anxious about going through a full underwriting process. But …

How a Maryland District is Using a Public-Private Partnership to Build 6 Schools in 3 Years

By Kara Arundel for K-12Dive Prince George’s County Public Schools will be the first district to use a P3 to bundle design, financing, construction and maintenance of a group of schools. To build just one school would typically take seven years, but through a public-private partnership (P3), which is thought to be the first in the nation to bundle the …

Is Your Bond Company Slowing Your Growth?

By Jamie Collum and Andrew Cartwright for Daily Commercial News As explained in the last Surety Corner, providing accurate and timely interim financial reporting is a key factor in successfully growing your bonding facility. The surety company wants to know throughout the year how your company is performing financially. When the results are positive this can lead to increased surety …

SBA Bond Guarantee Program – A Great Tool in Increasing Bonding Capacity

By Nick Newton for AssuredPartners Anyone working in the construction bond industry has seen the scenario where a client or prospect is requesting bonding capacity larger than the standard surety market is willing to provide. While some sureties will utilize tools like escrow or collateral, the SBA Bond Guarantee Program offers an alternative solution, enabling greatly increased capacity for your …

Contractor Blames Demise On Dispute With Florida DOT

By Scott Judy for Engineering News-Record Highway contractor D.A.B. Constructors is winding down operations and walking away from six ongoing projects after the Florida Dept. of Transportation defaulted it from a $33-million interchange project and allegedly failed to reimburse the Inglis, Fla.-based contractor more than $10 million in costs on a separate $31.8-million contract. In a statement published July 26, …

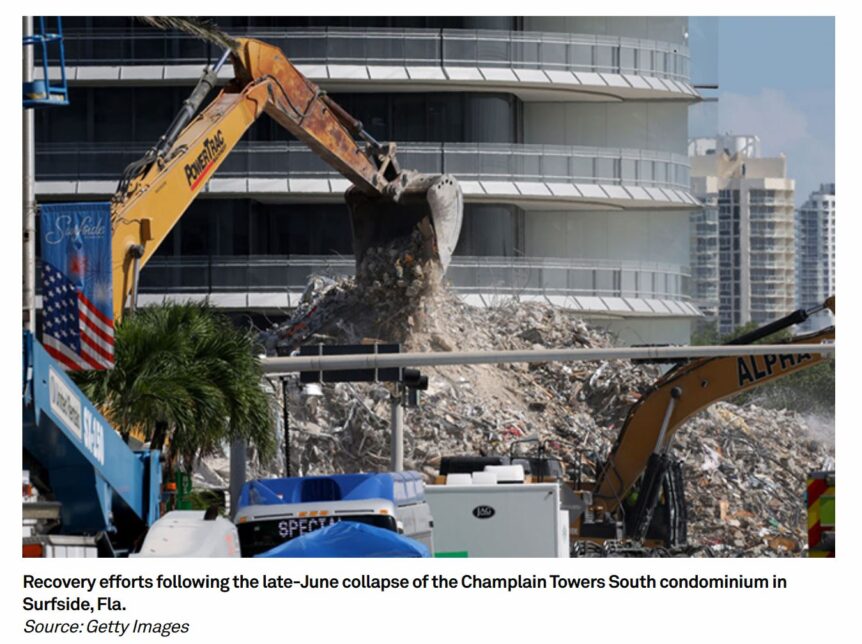

Florida Condo Tragedy Forces Risk Professionals to Rethink Building Integrity

By Calvin Trice and Jason Woleben for SPGlobal.com The deadly condominium collapse in Surfside, Fla., could reshape the way experts model catastrophe risk along a coastline that is already vulnerable to wind and water damage from tropical systems. Structural considerations typically take into account how a building could withstand hurricanes, but the flaws suspected as culprits in the sudden destruction …

PPP Loan Necessity Questionnaire Retired, Review Prep Still Critical

By Scott Tracy of CliftonLarsonAllen for NASBP.org Key insights: The SBA has dropped its loan necessity questionnaire requirement (Forms 3509 and 3510). Borrowers still need support for certifications related to the necessity of the PPP loan request. The SBA has up to six years from date of forgiveness to review the loan. The loan necessity questionnaire can provide guidance when …

Is Your Bond Company Slowing Your Growth?

By Jamie Collum and Andrew Cartwright for Canada.ConstructConnect.com The last edition of Surety Corner introduced the topic of bond limits, what might be holding back a contractor’s growth and the general areas of focus to ensure you are maximizing your bonding limits. The example we had used was contractor XYZ who had $500,000 in working capital, which translated to a …

A Guide To Bidding For, Procuring And Performing Federal Solar Contracts

By Christopher Horton, Partner, Smith, Currie & Hancock LLP for SolarPowerWorldOnlin.com The federal government is the largest energy purchaser in the United States, with an annual electricity bill for the fiscal year 2019 of almost $4 billion. As a result, President Biden’s administration is aggressively pursuing 100% clean energy and net-zero emissions by 2050. In fiscal year 2020, federal agencies …

SBA May Be Dropping PPP Loan Necessity Questionnaire Requirement

By Jeff Drew for JournalOfAccountancy.com The Associated General Contractors of America (AGC) said that the U.S. Small Business Administration (SBA) is in the process of removing the requirement that Paycheck Protection Program (PPP) borrowers submit a Loan Necessity Questionnaire when applying for forgiveness on loans of $2 million or more. A lender notice from an SBA district office also indicates …