Bonding University

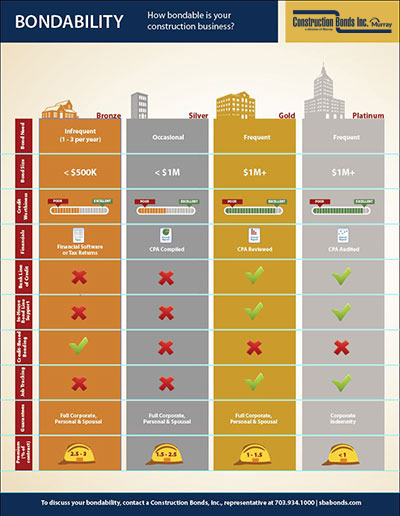

What is Your Company’s “Bondability”?

Not sure what you need or how to get started in order to obtain a surety bond? This infographic will help answer your questions. And if you’re still unsure, contact one of our bond representatives who can walk you through the process from start to finish, at 703.934.1000 or by email.

What is a Surety Bond?

A surety bond is a three-party agreement whereby the bond company (surety) assures the project owner (obligee) that the contractor (principal) will perform a contract in accordance with its documents and terms.

There are 3 basic types of contract Surety Bonds:

- Bid Bond – Assures the bid is submitted in good faith and that the contractor will enter into the contract at the bid price and provide the required performance and payment bonds.

- Performance Bond – Protects the owner from financial loss should the contractor fail to perform the contract in accordance with its terms and conditions.

- Payment Bond – Assures that the contractor will pay specified subcontractors, laborers, and materials suppliers associated with the project.

What Does a Bond Cost?

Surety bond premiums vary. CBI’s goals are aligned with their clients’ goals all the way because our team benefits only when we contribute to your success and help to provision a bond. Generally, the rate is between 1 and 3 percent.

How Long Does It Take to Get a Bond?

It depends on you! We have issued bonds in less than 24 hours. The size of the job, your company experience, financials and some other factors play a role in how long it takes.

Do I Have to Have an Audited Financial Statement to Get a Bond?

Not necessarily. While investing in a CPA-prepared financial statement is an important part of your growth as a contractor, the below guidelines may help you better understand what you can qualify for based on how your financials are currently prepared:

- In-House Financial Statement/Tax Return/CPA Compilation– Provides little to no assurance of the figures presented, but may be verified through bank statements, work in progress schedules and accounts receivable/payable reviews. For jobs up to $1,000,000.

- CPA Review – Consists principally of a thorough review of the contractor’s financial records and the application of certain analytical procedures to the financial data. Narrower in scope than a full audit, the review does provide reasonable assurance about the financial condition of the contractor. For jobs $1,000,000 and above.

- CPA Audit – Verifies relevant items in the financial statement with internal and external investigations of their accuracy. Sureties will likely require an audit for large contractor’s bonding programs.

Please note: This is simply a guide and there are exceptions. Additionally, the above statements are only as good as the person preparing them. CBI can help you find a construction-oriented CPA with industry experience to assist you.